Debt as a Tool: When Borrowing Builds Wealth — and When It Destroys It

By WealthQuizzes Editorial Team

Introduction: The Most Misunderstood Financial Instrument

Few financial concepts generate as much fear, confusion, and contradiction as debt.

Some people believe debt is evil and must be avoided at all costs. Others borrow recklessly, assuming growth will magically cover their obligations. Both extremes are dangerous.

The truth is simpler—and more uncomfortable:

Debt is neither good nor bad. It is a multiplier.

Used wisely, debt accelerates growth, productivity, and wealth creation. Used poorly, it compounds losses, stress, and economic collapse.

Understanding when debt works—and when it doesn’t—is a foundational financial skill.

What Debt Really Is: Leverage, Not Income

At its core, debt is borrowed future income.

When you borrow, you are making a bet that:

- Future cash flow will be higher than today’s, and

- That increase will be sufficient to repay the loan plus interest.

Debt magnifies outcomes:

- If returns exceed borrowing costs → wealth grows

- If returns fall short → losses compound

Debt does not create value on its own. It only amplifies the quality of decisions behind it.

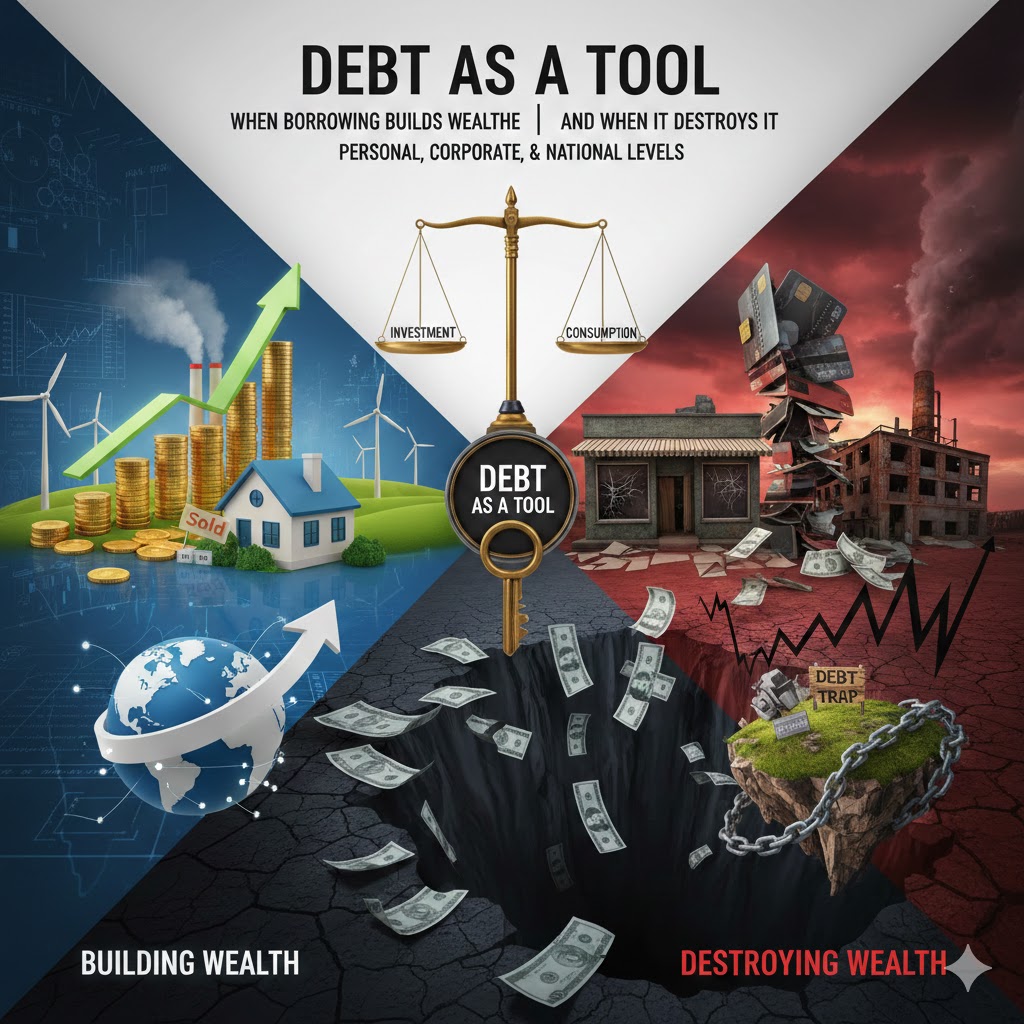

Productive Debt vs. Destructive Debt: The Fundamental Divide

The most important distinction in debt literacy is this:

Productive Debt

Debt that:

- Generates income or productivity

- Improves future cash flow

- Builds assets or capacity

- Pays for itself over time

Destructive Debt

Debt that:

- Funds consumption without returns

- Has no sustainable repayment source

- Grows faster than income

- Relies on hope instead of cash flow

This distinction applies universally—to individuals, businesses, and nations.

Personal Debt: When Borrowing Builds or Breaks Lives

Productive Personal Debt

Examples include:

- Education that increases earning capacity

- A mortgage for a reasonably priced home

- A business loan with clear cash flow

- Skills or tools that generate income

These debts:

- Expand future income

- Create long-term assets

- Improve financial resilience

Destructive Personal Debt

Examples include:

- High-interest consumer loans

- Lifestyle debt for status purchases

- Credit card balances without repayment plans

- Borrowing to cover recurring expenses

This type of debt:

- Produces no income

- Shrinks future options

- Turns time into an enemy

- Traps people in repayment cycles

At the personal level, debt becomes dangerous when income does not grow faster than obligations.

Corporate Debt: Fuel for Growth or a Silent Killer

Businesses use debt constantly—but the difference between success and failure lies in purpose and structure.

Productive Corporate Debt

Used for:

- Expanding operations

- Purchasing productive assets

- Entering profitable markets

- Improving efficiency or scale

Well-managed corporate debt:

- Matches repayment to cash flow

- Is supported by predictable revenue

- Is used to grow margins, not just size

Destructive Corporate Debt

Occurs when companies:

- Borrow to cover losses

- Use debt to mask poor management

- Over-leverage during booms

- Ignore cash flow volatility

Many corporate collapses are not due to lack of profit—but excessive leverage.

Debt doesn’t kill businesses.

Mismatch between debt and cash flow does.

National Debt: Development Tool or Economic Trap

At the national level, debt becomes even more complex—and more dangerous.

Productive National Debt

Used for:

- Infrastructure that boosts productivity

- Education and healthcare systems

- Industrial capacity

- Long-term economic transformation

When managed well, national debt:

- Expands the economic base

- Increases future tax capacity

- Improves competitiveness

- Pays for itself over time

Destructive National Debt

Occurs when borrowing:

- Funds recurrent consumption

- Covers inefficiencies

- Supports corruption or waste

- Is denominated in volatile foreign currencies

This leads to:

- Debt servicing crises

- Currency pressure

- Inflation

- Reduced sovereignty

Countries do not fail because they borrow.

They fail because borrowed money does not increase productive capacity.

The Interest Rate Reality: The Silent Decider

Debt becomes destructive when interest outpaces growth.

At any level, the critical question is:

Is the return on borrowed money higher than the cost of borrowing?

If not:

- Wealth erodes

- Options shrink

- Risk compounds

This is why:

- High-interest consumer loans are dangerous

- Floating-rate debt can be lethal in inflationary periods

- Currency-mismatched debt is risky for nations

Ignoring interest is how debt quietly turns toxic.

Why Poor Decisions Turn Debt into a Weapon

Debt becomes destructive when driven by:

- Emotion instead of analysis

- Optimism instead of projections

- Short-term thinking

- Lack of financial literacy

Many debt crises—personal, corporate, and national—are not caused by borrowing itself, but by poor understanding of cash flow, risk, and timing.

How to Know Whether Debt Will Build or Destroy Wealth

Before taking on any debt, ask:

- What exactly will this money produce?

- How and when will it generate cash flow?

- Is repayment dependent on growth or speculation?

- What happens if income falls?

- Is this debt optional—or survival-driven?

If these questions cannot be answered clearly, the debt is likely destructive.

African Context: Debt, Development, and Discipline

Across Africa:

- SMEs struggle due to lack of productive credit

- Individuals fall into high-interest lending traps

- Governments borrow without structural reforms

The problem is not access to debt.

It is access to disciplined, productive borrowing frameworks.

Financial literacy is the missing link between debt and development.

WealthQuizzes Perspective: Debt Literacy Is Wealth Literacy

At WealthQuizzes, we believe understanding debt is not optional—it is survival knowledge.

When people understand:

- How debt works

- When to use it

- When to avoid it

- How to structure it

Debt stops being a trap and becomes a tool.

We teach that:

- Borrowing is not failure

- Avoiding all debt is not wisdom

- Strategic debt is leverage

- Undisciplined debt is destruction

Because wealth is not built by avoiding tools—

it is built by using them intelligently.

And debt, when understood, is one of the most powerful tools of all.