Financial Literacy vs Financial Power: Why Knowing Isn’t the Same as Owning

Introduction: Knowledge Without Control

Over the past decade, financial literacy has become a popular solution to economic inequality. Governments, NGOs, fintechs, and content creators all promote the idea that if people simply understand money better—budgeting, saving, investing—their financial outcomes will improve.

While financial literacy is undeniably important, it is not the same thing as financial power.

Millions of people today understand money better than previous generations, yet remain economically fragile. They know how wealth works, but do not control the assets, institutions, or systems that generate and preserve it. This gap between knowing and owning is one of the most misunderstood realities in modern economics—especially in developing economies like Africa.

This article explains why financial literacy alone is insufficient, what financial power actually means, and how individuals and societies can move from education to economic leverage.

What Financial Literacy Really Means

Financial literacy refers to the ability to understand and use basic financial concepts, including:

- Budgeting and cash flow management

- Saving and interest

- Debt and credit

- Inflation and purchasing power

- Basic investing principles

At its best, financial literacy helps individuals:

- Avoid obvious financial mistakes

- Plan short- and medium-term goals

- Make informed consumer decisions

However, financial literacy does not guarantee access, opportunity, or influence. It teaches people how money works—but not who controls it.

In simple terms:

Financial literacy helps you play the game better.

Financial power determines who sets the rules.

What Financial Power Actually Is

Financial power is the ability to influence economic outcomes, allocate capital, and shape financial decisions at scale. It flows from ownership and control, not just knowledge.

Financial power comes from:

- Ownership of productive assets (land, businesses, equity, IP)

- Control of capital (banks, funds, investment vehicles)

- Access to large pools of money

- Influence over policy, regulation, and markets

- Position within economic networks

A financially literate person may understand interest rates.

A financially powerful entity decides what interest rates apply, who gets credit, and on what terms.

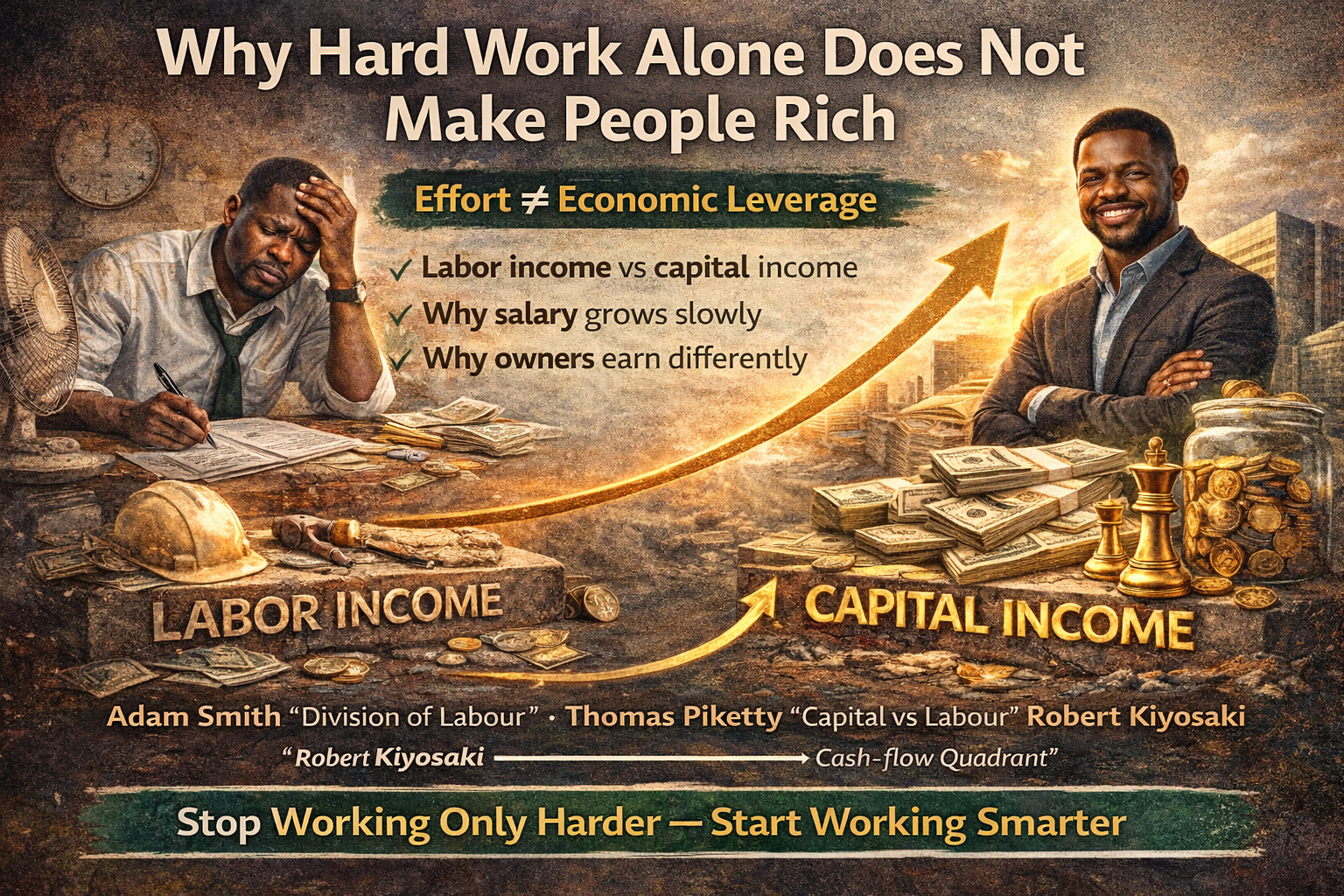

Why Knowing Isn’t the Same as Owning

1. Education Does Not Equal Access

A small business owner may understand how loans work perfectly—but still be denied credit due to:

- Lack of collateral

- Informality

- Weak credit history

- Systemic bias

Meanwhile, large corporations with average management may borrow cheaply simply because they already control assets and relationships.

Knowledge cannot compensate for structural exclusion.

2. Wealth Is Built Through Asset Control, Not Advice

Reading about investing does not equal owning investments. Understanding real estate does not equal owning land. Knowing how businesses scale does not equal owning equity in them.

Wealth accumulates where cash flows are owned, not merely understood.

This is why:

- Employees often remain financially constrained despite high education

- Renters understand property markets but do not benefit from appreciation

- Consumers fund corporate profits without sharing ownership

Financial Literacy vs Financial Power: Why Knowing Isn’t the Same as Owning

3. Financial Systems Favor Existing Power

Financial systems are designed to protect capital, not distribute it evenly. Banks, markets, and institutions prioritize:

- Risk minimization

- Asset-backed lending

- Proven track records

- Network trust

Those without assets face higher interest rates, stricter conditions, or total exclusion—regardless of how financially literate they are.

The African Context: Literacy Without Leverage

Africa has made significant progress in financial education and digital access. Mobile money, fintech platforms, and online content have increased awareness dramatically.

Yet:

- Asset ownership remains concentrated

- Capital formation is weak

- Local financial institutions are underpowered

- Foreign capital dominates strategic sectors

Many Africans are financially aware but economically dependent.

This explains why:

- People save diligently but remain vulnerable to shocks

- Entrepreneurs understand growth but lack scale capital

- Nations educate citizens but outsource financial infrastructure

From Financial Literacy to Financial Power

The solution is not to abandon financial literacy, but to move beyond it.

1. Shift the Focus From Consumption to Ownership

True financial empowerment prioritizes:

- Equity ownership

- Business stakes

- Land and productive assets

- Intellectual property

- Cooperative and collective ownership models

Teaching people how to save is useful. Teaching them how to own is transformative.

2. Build Institutions, Not Just Individuals

Financial power scales through institutions:

- Strong local banks

- Credit unions and cooperatives

- Pension and investment funds

- Sovereign and development funds

- Regional payment and settlement systems

Individuals gain power when they are connected to institutions that mobilize capital.

3. Democratize Capital, Not Just Information

Technology can bridge this gap if used correctly:

- Fractional ownership platforms

- Tokenized assets

- SME-focused credit infrastructure

- Community investment vehicles

- Transparent capital markets

Information must lead to participation, not passive understanding.

The Role of WealthQuizzes: Knowledge as a Gateway, Not the Destination

WealthQuizzes is built on the principle that learning should lead to earning and ownership. Financial education is not presented as an end in itself, but as a foundation for smarter participation in economic systems.

By connecting:

- Financial literacy

- Technology

- Incentives

提醒 users see money not just as something to manage—but as something to command through informed action.

Conclusion: Power Comes After Understanding—But It Must Follow

Financial literacy is necessary, but it is not sufficient.

A society can be educated and still poor.

An individual can be knowledgeable and still powerless.

Real financial freedom emerges when knowledge is paired with:

- Asset ownership

- Capital access

- Institutional participation

- Long-term control over economic flows

In the end, knowing how money works is step one.

Owning the structures through which money works is step two.

And it is step two that changes lives, communities, and nations.