How Global Capital Moves: Why Money Flows to Some Countries and Avoids Others

Introduction: Capital Has No Passport, Only Preferences

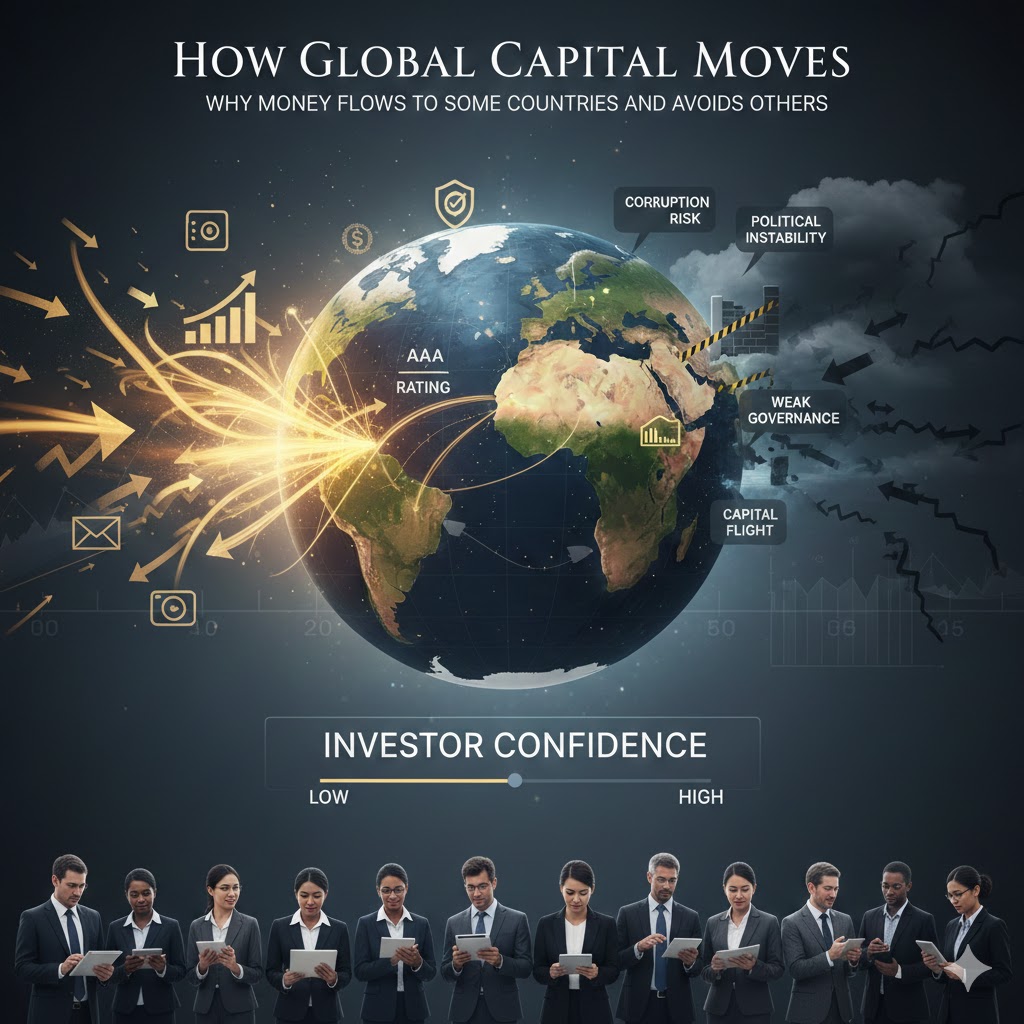

In today’s interconnected financial system, capital moves faster than people, goods, or governments can react. Trillions of dollars flow daily across borders in search of safety, yield, liquidity, and strategic advantage. Yet this movement is not random. Some countries consistently attract foreign investment, while others struggle to retain domestic capital, let alone draw global funds.

Understanding how and why global capital moves requires more than slogans about “foreign investors” or “market forces.” It requires examining risk perception, institutional credibility, macroeconomic discipline, and confidence — the true currencies of international finance.

As economist John Maynard Keynes observed, markets are driven not only by fundamentals but by “animal spirits” — the collective psychology of investors. In global capital markets, perception often matters as much as reality.

The Nature of Global Capital

Global capital comprises multiple forms, each with distinct motivations:

- Foreign Direct Investment (FDI): Long-term commitments to productive assets such as factories, infrastructure, and businesses.

- Portfolio Investment: Equity and debt investments seeking returns, liquidity, and diversification.

- Sovereign and Institutional Capital: Funds from pension funds, sovereign wealth funds, insurance companies, and multilateral institutions.

- Speculative or Short-Term Capital: Often referred to as “hot money,” highly sensitive to interest rates, currency risk, and political signals.

Each category responds differently to risk, but all are governed by the same core question: Is this country a safe and predictable place for capital to grow?

Risk Perception: The First Gatekeeper

Capital does not flow to the highest returns; it flows to the best risk-adjusted returns. This principle, formalized in modern portfolio theory by Harry Markowitz, underpins global investment decisions.

Investors assess country risk through several lenses:

- Political Stability: Frequency of coups, civil unrest, abrupt policy reversals.

- Rule of Law: Strength of courts, contract enforcement, property rights.

- Macroeconomic Stability: Inflation control, debt sustainability, fiscal discipline.

- Currency Risk: Exchange rate volatility and capital controls.

- Policy Credibility: Independence of central banks and regulatory consistency.

Countries perceived as unpredictable face higher risk premiums, making capital more expensive or entirely inaccessible.

Credit Ratings and the Cost of Trust

Sovereign credit ratings issued by agencies such as Moody’s, Standard & Poor’s, and Fitch act as global shorthand for risk. These ratings influence:

- Interest rates on sovereign bonds

- Access to international debt markets

- Eligibility for institutional investment mandates

A downgrade signals increased default risk or policy uncertainty, often triggering capital outflows. Conversely, an upgrade can unlock billions in new investment flows.

As former IMF Chief Economist Olivier Blanchard noted, “Markets can tolerate bad news. What they cannot tolerate is uncertainty about policy direction.”

Investor Confidence and Institutional Quality

Empirical research by economists such as Daron Acemoglu and James Robinson has consistently shown that institutions — not natural resources or geography — determine long-term capital attraction.

Countries that attract sustained capital typically exhibit:

- Independent central banks

- Transparent fiscal frameworks

- Predictable tax regimes

- Professional regulatory agencies

- Respect for private ownership

Weak institutions raise the probability of expropriation, capital controls, or arbitrary regulation — all red flags for investors.

Capital Flight: When Money Leaves Home

Capital flight occurs when domestic investors move assets abroad due to fear of devaluation, confiscation, inflation, or instability. This phenomenon has affected economies from Latin America to Africa to Eastern Europe.

According to World Bank and IMF studies, capital flight is often driven by:

- Rapid inflation or currency depreciation

- Excessive government borrowing

- Political repression or conflict

- Sudden policy shocks (e.g., bank freezes, currency redenomination)

Ironically, capital flight often precedes crises, acting as an early warning signal of declining confidence.

Interest Rates, Global Cycles, and Monetary Power

Global capital flows are also shaped by monetary policy in dominant economies, particularly the United States. When the U.S. Federal Reserve tightens monetary policy:

- Capital often flows from emerging markets back to U.S. assets

- Local currencies weaken

- Borrowing costs rise in capital-importing countries

This dynamic, explained by the Mundell–Fleming model, demonstrates how global liquidity conditions can overwhelm domestic fundamentals.

Emerging economies with weak buffers are especially vulnerable during global tightening cycles.

Why Some Countries Win the Capital Game

Countries that consistently attract capital tend to share common characteristics:

- Policy continuity across administrations

- Low and stable inflation

- Open but regulated capital markets

- Strong investor protection laws

- Long-term economic planning

Examples include Singapore, Switzerland, Canada, and increasingly certain Asian economies that have prioritized credibility over populism.

As former World Bank President Robert Zoellick stated, “Capital flows where governance is predictable and the rules are known in advance.”

Why Others Are Avoided — Even with High Returns

Some countries offer extraordinary returns on paper yet repel capital in practice. Common deterrents include:

- Policy unpredictability and sudden regulation

- Weak judicial systems

- Excessive state intervention

- Chronic fiscal deficits

- Political risk without institutional safeguards

High returns cannot compensate for the risk of capital loss, trapped funds, or arbitrary rule changes.

Conclusion: Capital Is a Vote of Confidence

Global capital allocation is not a moral judgment; it is a confidence referendum. Every dollar invested represents trust in a country’s leadership, institutions, and future trajectory.

Nations that understand this reality design policies that reduce uncertainty, strengthen institutions, and protect capital — even when politically inconvenient. Those that ignore it often blame external forces while capital quietly exits.

In the end, money is not loyal. It does not respect borders or narratives. It flows toward stability, credibility, and foresight — and away from chaos, inconsistency, and short-term thinking.

Understanding how global capital moves is not merely an academic exercise. It is a prerequisite for national prosperity in a world where confidence is the most valuable asset of all.