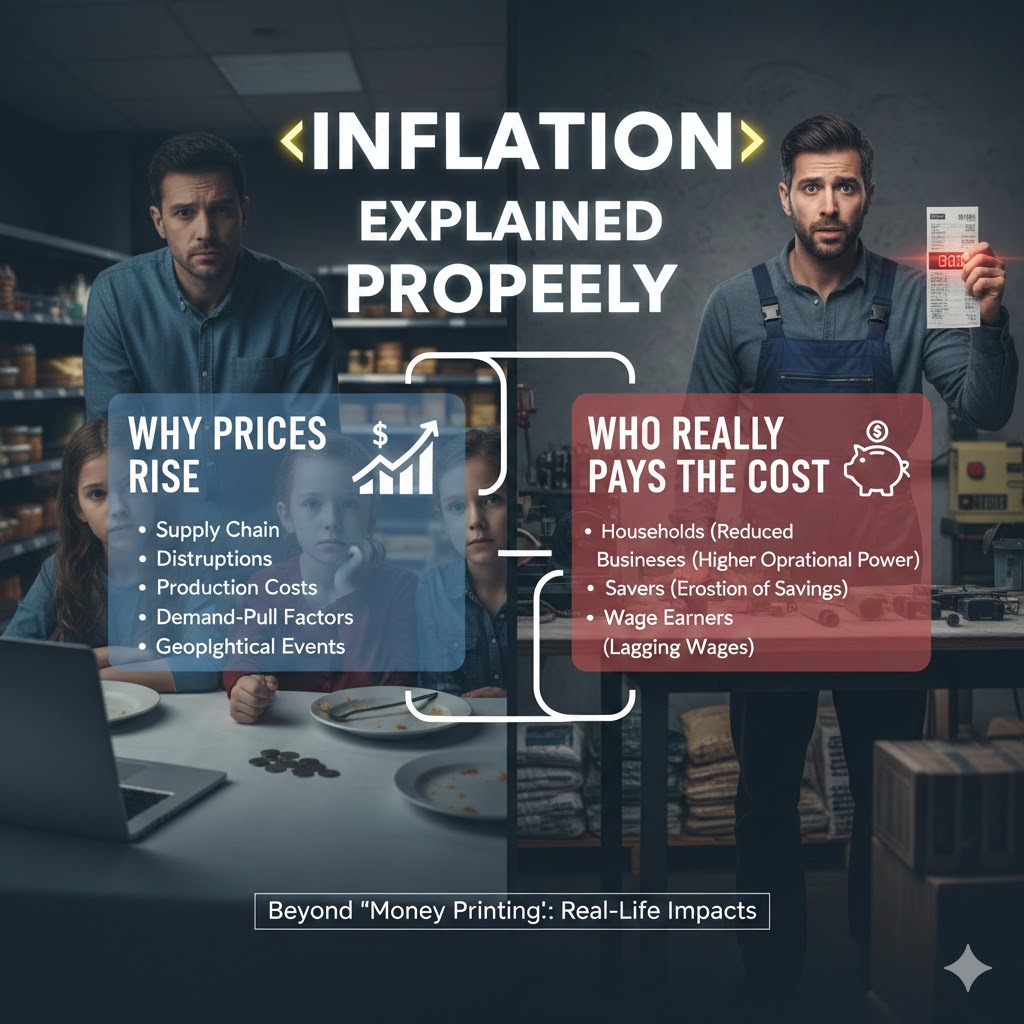

Inflation Explained Properly: Why Prices Rise and Who Really Pays the Cost

By WealthQuizzes Editorial Team

Introduction: Inflation Is Not Just “Money Printing”

When prices rise, the most common explanation people hear is simple:

“The government printed too much money.”

While money creation can contribute to inflation, this explanation is incomplete and often misleading. Inflation is not a single event or policy failure. It is the result of interacting economic forces, structural weaknesses, and human behavior.

To truly understand inflation, we must answer two questions:

- Why do prices rise?

- Who actually bears the cost when they do?

What Inflation Really Is

Inflation is a sustained increase in the general price level of goods and services over time. In simple terms, it means each unit of money buys less than it used to.

Inflation is not about one product becoming expensive. It is about broad purchasing power erosion across the economy.

Importantly, inflation is:

- A process, not a moment

- A distributional force, not a neutral one

- A symptom as much as a cause

The Real Causes of Inflation (Beyond Printing Money)

1. Demand-Pull Inflation

This occurs when demand grows faster than supply.

Examples:

- Population growth without matching production

- Government spending surges

- Credit expansion fueling consumption

When too many buyers chase too few goods, prices rise.

2. Cost-Push Inflation

This happens when production costs increase, forcing businesses to raise prices.

Key drivers include:

- Fuel and energy costs

- Currency depreciation (raising import prices)

- Wage increases not matched by productivity

- Supply chain disruptions

In many African economies, cost-push inflation is a dominant force due to import dependence and energy instability.

3. Exchange Rate Inflation

When a country’s currency weakens, imports become more expensive.

This affects:

- Food

- Fuel

- Medicine

- Industrial inputs

Because many African economies import critical goods, currency weakness directly translates into higher domestic prices, even without increased demand.

4. Structural Inflation

This stems from deep economic inefficiencies, such as:

- Poor infrastructure

- Insecurity affecting food supply

- Logistics bottlenecks

- Market monopolies

- Weak competition

Structural inflation persists even when money supply is stable.

5. Expectations and Psychology

Inflation feeds on belief.

When businesses expect higher prices:

- They raise prices preemptively

- Workers demand higher wages

- Consumers rush purchases

This creates a self-reinforcing cycle where expectations alone push prices higher.

Why Inflation Hurts Some People More Than Others

Inflation is often described as a “general” problem, but its effects are unevenly distributed.

Who Suffers the Most

- Fixed-income earners

- Low-income households

- Informal workers

- Small businesses with thin margins

- Savers holding cash

These groups cannot adjust income as fast as prices rise.

Who Is Less Affected—or Even Benefits

- Asset owners (real estate, stocks, commodities)

- Debtors with fixed-rate loans

- Businesses with pricing power

- Governments with domestic debt

Inflation quietly redistributes wealth—from savers to borrowers, from wage earners to asset holders.

The Business Impact: Inflation as a Silent Tax

For businesses, inflation is not just higher costs—it is uncertainty.

Effects include:

- Unpredictable input prices

- Shrinking profit margins

- Higher working capital needs

- Reduced consumer purchasing power

- Difficult pricing decisions

SMEs are especially vulnerable because they:

- Lack pricing power

- Have limited access to credit

- Face volatile cash flows

Inflation acts like a tax without legislation, draining value invisibly.

Why Central Banks Fight Inflation Aggressively

Central banks target inflation because:

- Persistent inflation destroys savings

- It distorts investment decisions

- It erodes trust in the currency

- It fuels social instability

Their main weapon is interest rates.

By raising rates, central banks:

- Reduce borrowing

- Slow spending

- Stabilize currencies

- Anchor expectations

However, tightening also slows growth—creating a difficult trade-off.

African Reality: Why Inflation Is Harder to Control

In many African economies:

- Inflation is driven by supply shocks, not excess demand

- Interest rate hikes do not fix infrastructure or insecurity

- Import dependence limits policy effectiveness

- Currency pressures amplify domestic costs

This makes inflation management structurally harder than in advanced economies.

How Individuals Can Protect Themselves from Inflation

While inflation is a macroeconomic issue, individuals can respond strategically:

- Avoid holding excess idle cash

- Invest in productive assets

- Improve income flexibility

- Build inflation-aware budgets

- Understand interest rate dynamics

Inflation punishes ignorance more than it punishes poverty.

WealthQuizzes Perspective: Inflation Is a Literacy Issue

At WealthQuizzes, we believe inflation is not just an economic challenge—it is an education challenge.

When people understand:

- Why prices rise

- How inflation spreads

- Who bears the burden

- How systems transmit costs

They stop reacting emotionally and start responding intelligently.

Inflation will always exist.

What changes outcomes is how well people understand it.

Because in economics, as in life,

those who understand the forces at work suffer less from them.