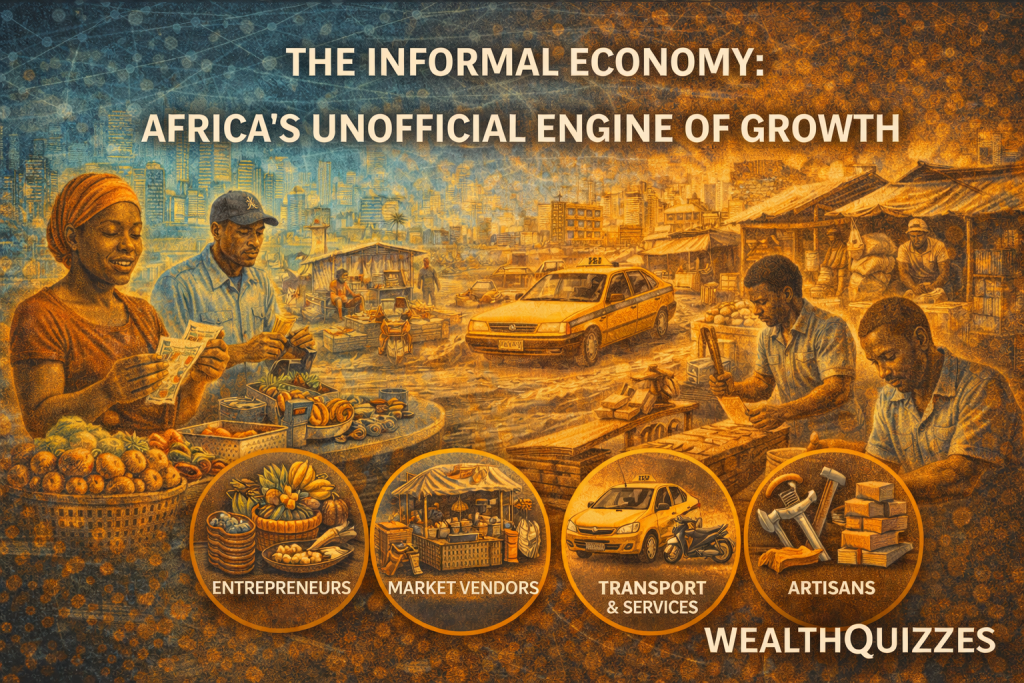

The Informal Economy: Africa’s Unofficial Engine of Growth

By WealthQuizzes Editorial Team

Introduction: Informality Is Not Failure

Across Africa, the informal economy is often spoken about as a problem to be solved—a sign of underdevelopment, weak institutions, or regulatory failure. Policymakers promise to “formalize” it, economists measure it as a gap, and commentators treat it as a temporary phase.

Yet this framing misses a crucial truth:

Africa’s informal economy is not a breakdown of the system—it is the system for millions of people.

Far from being marginal, the informal economy employs the majority of Africa’s workforce, feeds urban populations, supports rural livelihoods, and keeps commerce moving where formal structures fall short. Understanding it properly is essential to understanding African growth.

What the Informal Economy Really Is

The informal economy consists of economic activities that are not fully regulated, registered, or taxed by the state, but are nonetheless productive and income-generating.

It includes:

- Market traders and street vendors

- Artisans, mechanics, tailors, and builders

- Small-scale farmers and processors

- Transport operators

- Home-based enterprises

- Micro-retail and services

Informality does not mean illegality. It usually reflects:

- High barriers to formal registration

- Complex or costly regulation

- Weak enforcement capacity

- Limited access to finance and documentation

In many cases, informality is a rational response to institutional constraints—not a rejection of legality.

Scale and Significance: The Backbone of African Economies

In most African countries:

- The informal sector employs 60–90% of the workforce

- It contributes 30–60% of GDP

- It dominates agriculture, retail, transport, and services

Without the informal economy:

- Urban food systems would collapse

- Youth unemployment would explode

- Household incomes would shrink dramatically

Calling Africa’s informal economy “unproductive” ignores its role as the primary shock absorber in times of crisis—economic downturns, pandemics, inflation, and conflict.

Why Informality Persists: Structural, Not Cultural

Informality is often blamed on attitudes or “resistance to formality.” In reality, it persists because of structural incentives.

1. High Cost of Formality

Registering a business can involve:

- Multiple agencies

- High fees

- Time-consuming processes

- Ongoing compliance costs

For a micro-entrepreneur earning thin margins, these costs are prohibitive.

2. Weak Benefits of Formality

In many contexts, formalization does not guarantee:

- Access to credit

- Reliable infrastructure

- Legal protection

- Government support

When benefits are unclear, informality becomes the rational choice.

3. Inconsistent Enforcement

Selective enforcement encourages partial compliance:

- Informal enough to avoid costs

- Visible enough to operate

This grey zone sustains informality indefinitely.

Productivity in the Informal Economy: Misunderstood, Not Absent

The informal economy is often described as “low productivity.” This is partially true—but misleading.

Low productivity is not due to lack of effort or intelligence. It reflects:

- Limited access to capital

- Poor infrastructure

- Small operating scale

- Cash-based transactions

- Lack of technology

Given these constraints, informal enterprises often display remarkable efficiency and resilience.

Productivity is suppressed by environment—not capability.

The Costs of Informality

While informality sustains livelihoods, it also imposes real costs.

For Workers

- No social protection

- Income volatility

- Limited upward mobility

For Businesses

- No access to affordable credit

- Difficulty scaling

- Exposure to harassment or extortion

For Governments

- Narrow tax base

- Weak planning data

- Limited fiscal capacity

The challenge, therefore, is not whether to formalize—but how.

Why Traditional Formalization Fails

Many formalization efforts fail because they are:

- Top-down

- Punitive

- Bureaucratic

- Disconnected from reality

Forcing informal businesses into rigid frameworks often:

- Pushes them further underground

- Destroys livelihoods

- Reduces trust in institutions

Formalization that ignores incentives becomes economic disruption, not development.

Smart Formalization: A Gradual, Incentive-Based Approach

Intelligent formalization starts from a different premise:

Meet people where they are—not where policy expects them to be.

Effective strategies include:

1. Simplified Registration

- Low-cost, one-step business IDs

- Mobile and digital platforms

- Local-language processes

2. Tangible Benefits

Formal status must unlock:

- Access to credit

- Secure payment systems

- Business training

- Market access

Without benefits, formality is symbolic.

3. Digital Financial Integration

Mobile money, POS systems, and digital wallets create:

- Transaction records

- Financial identity

- Creditworthiness

This allows businesses to formalize economically before doing so legally.

4. Graduated Taxation

Instead of immediate tax burdens:

- Small levies

- Turnover-based systems

- Threshold exemptions

This builds compliance without killing growth.

Fintech and the New Path to Formality

Technology is quietly reshaping the formalization debate.

Digital tools now allow:

- Informal businesses to build credit profiles

- Governments to map economic activity

- Lenders to price risk accurately

In many cases, financial inclusion precedes legal inclusion—and that’s a feature, not a flaw.

African Reality: Informality as a Development Phase, Not a Dead End

Every developed economy passed through periods of informality. What matters is transition, not eradication.

Africa’s challenge is not to eliminate the informal economy—but to:

- Reduce its vulnerability

- Increase its productivity

- Integrate it into growth pathways

Informality is a starting point. Development is the journey.

WealthQuizzes Perspective: Understanding the Economy as It Is

At WealthQuizzes, we believe financial literacy must reflect economic reality, not textbook ideals.

Understanding the informal economy helps people:

- See opportunity where others see disorder

- Make smarter business decisions

- Navigate systems strategically

- Engage policy debates intelligently

Africa’s growth story will not be written solely in boardrooms or stock exchanges.

It is already being written—in markets, workshops, farms, and streets.

Recognizing that truth is not lowering standards.

It is building development on solid ground.

Because real economies grow from where people are—not from where we wish they were.