The Silent Wealth Killers: Fees, Inflation Drag, and Opportunity Cost

By WealthQuizzes Editorial Team

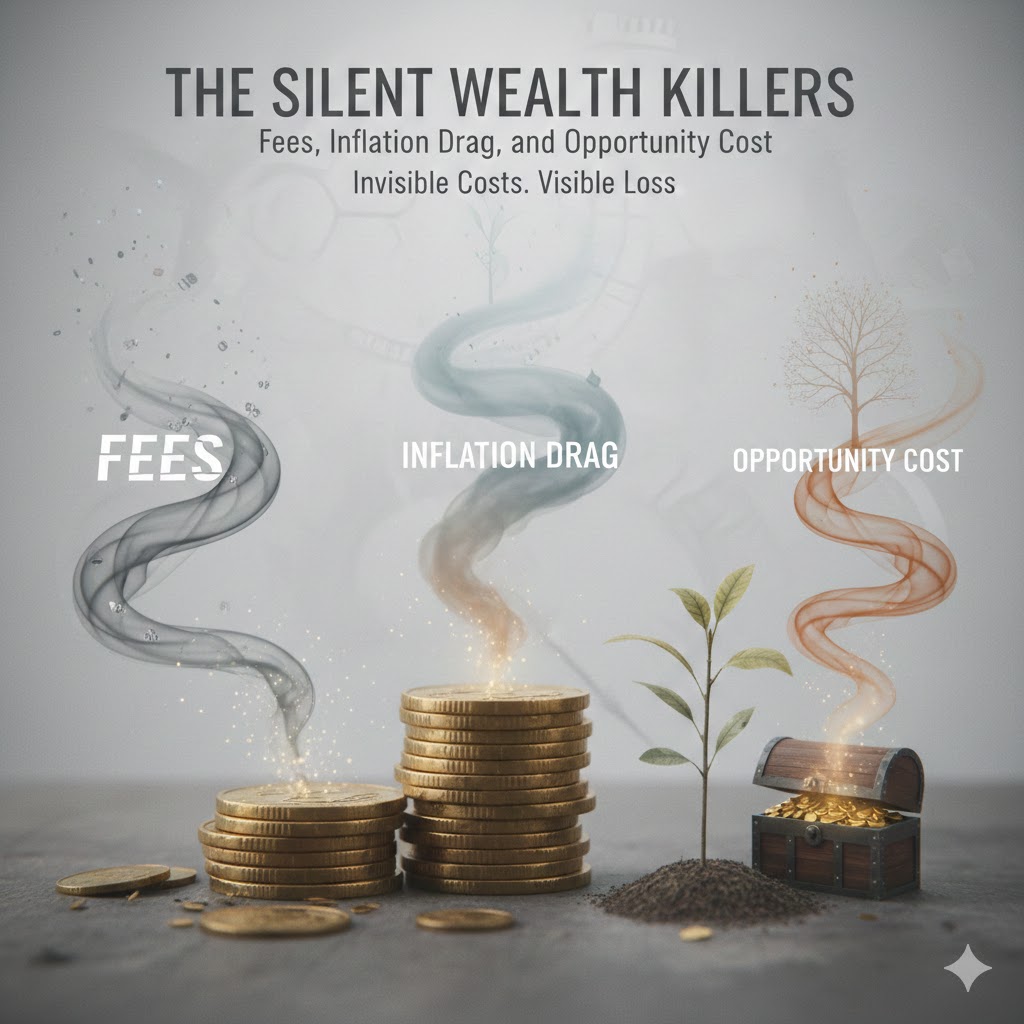

Introduction: Wealth Erosion Happens Quietly

Most people focus on how much money they earn, but true financial resilience depends even more on how much wealth they keep. Many savers and investors are blindsided by invisible forces that shave off returns year after year. These are the wealth killers that hide in plain sight: fees, inflation drag, and opportunity cost.

Unlike a market crash, these factors rarely make headlines. Yet over the long term, they can obliterate the benefits of disciplined saving or smart investing. Nobel laureate William F. Sharpe, whose work on risk and return forms the backbone of modern portfolio theory, warned that “returns net of costs” are what truly matter for wealth accumulation. The arithmetic of these silent drains is unforgiving.

This article explains how these forces operate, quantifies their impact, and offers strategies to mitigate them.

1. Fees: The Invisible Tax on Your Returns

Fees are ubiquitous in financial markets and personal finance. They appear in:

- Mutual fund expense ratios

- Brokerage commissions

- Account maintenance fees

- Advisory and management fees

- Transaction and performance fees

Over time, even seemingly small fees compound into giant wealth drains.

The Mathematics of Fees

Consider two portfolios earning a 7% annual return:

- Portfolio A charges 0.25% in fees

- Portfolio B charges 1.25% in fees

After 30 years, Portfolio A will be worth nearly 30% more than Portfolio B—even though both earned the same nominal return.

This phenomenon is often referred to as “fee drag.” The truth is simple: fees are paid first, and returns are earned after fees. What you keep is what you compound.

Authority Insight

Morningstar CEO Kendra Thompson and research director Christine Benz have repeatedly demonstrated that lower-cost funds outperform higher-cost peers over long periods. Their 2021 study showed that the average actively managed fund underperformed low-cost index funds, largely due to higher fees.

2. Inflation Drag: When Your Money Shrinks in Value

Inflation is the rate at which the general level of prices rises, reducing the purchasing power of money. While central banks like the U.S. Federal Reserve aim for a target inflation rate around 2%, many developing economies experience far higher inflation rates.

For example:

- A 5% inflation rate means that ₦100 today buys the same goods that would cost ₦105 tomorrow.

- Over ten years, a constant 5% inflation rate erodes purchasing power by roughly 40%.

This loss is known as inflation drag.

Understanding Real vs. Nominal Returns

Investors often focus on nominal returns—the percentage gain expressed in currency terms. But what matters is real returns—returns adjusted for inflation.

For example:

- A savings account yielding 7% per year may feel generous.

- But with 5% inflation, the real return is only about 2%.

This forces investors to pursue assets that outpace inflation, such as equities, real estate, or inflation-protected securities.

Expert View

Economist Milton Friedman famously stated:

“Inflation is taxation without legislation.”

This captures the crux of inflation drag: it reduces wealth without any explicit deduction, unlike taxes or fees.

3. Opportunity Cost: The Wealth You Never Accumulate

Opportunity cost represents the benefits you miss out on when choosing one investment over another. It is not a fee you pay, nor an erosion like inflation. Instead, it is the wealth you never create because of the choices you didn’t make.

Opportunity Cost in Practice

Consider two choices:

- Putting ₦100,000 in a low-yield savings account

- Investing that same amount in a diversified index fund

Over 20 years, compounded returns from the index fund could be several times greater than the savings account. The difference isn’t a fee or inflation—it is the value of the opportunity forgone.

This concept applies broadly:

- Choosing cash over productive assets

- Holding assets too long out of fear

- Avoiding diversified strategies due to short-term thinking

Opportunity cost is the wealth that never materializes.

Behavioral Insight

Behavioral economist Richard Thaler, a key figure in understanding economic decision-making, noted that individuals often overweight short-term certainty and underweight long-term potential. This leads to choices that feel safe but destroy wealth potential.

Why These Forces Compound Against You

The silent wealth killers interact in a way that accelerates erosion:

- Fees reduce nominal returns

- Inflation shrinks purchasing power

- Opportunity cost ensures you never catch up

For example, a poorly structured investment that charges high fees, yields returns that barely beat inflation, and lacks growth exposure will result in significantly less wealth compared to a low-fee, real-return-oriented investment.

Strategies to Mitigate Silent Wealth Killers

1. Minimize Fees

- Favor low-cost index funds and ETFs over high-fee active management

- Use fee-aware advisors

- Avoid frequent trading that incurs commissions and spread costs

2. Focus on Real Returns

- Prioritize investments that outpace inflation

- Include assets like equities, real estate, and inflation-protected instruments

- Maintain a long-term perspective

3. Reduce Opportunity Cost

- Invest consistently rather than waiting for “perfect timing”

- Rebalance portfolios to capture growth opportunities

- Educate yourself on risk vs. reward trade-offs

Each strategy reinforces the other. Together, they protect and expand wealth more effectively than focusing on any one area in isolation.

Implications for African Investors

In many African economies, inflation rates exceed global averages, and financial markets are less developed. This makes:

- Fee awareness even more critical

- Real return orientation essential

- Opportunity cost decisions more impactful

Mobile money, fintech investment platforms, and growing capital markets provide new opportunities—but only if participants understand the silent costs at work.

WealthQuizzes Perspective: Beyond Knowledge to Action

Financial literacy alone—knowing what inflation or fees are—does not prevent wealth erosion. What distinguishes successful wealth builders is the discipline to act on that knowledge.

At WealthQuizzes, we believe education must translate into financial behavior change:

- Choosing lower-cost vehicles

- Thinking in real returns

- Evaluating opportunity cost before every major decision

Because wealth is not just about how much you earn—it’s about how much you keep and grow.

Conclusion: Wealth Preservation Requires Vigilance

Fees, inflation drag, and opportunity cost often work quietly, invisibly, and cumulatively. They seldom make headlines, yet they are some of the most potent barriers to genuine wealth creation.

Reducing these silent wealth killers requires:

- Strategic thinking

- Discipline

- Informed decision-making

- Long-term perspective

And ultimately, it requires recognizing that wealth is maximized not by accident, but by intentional financial behavior over time.